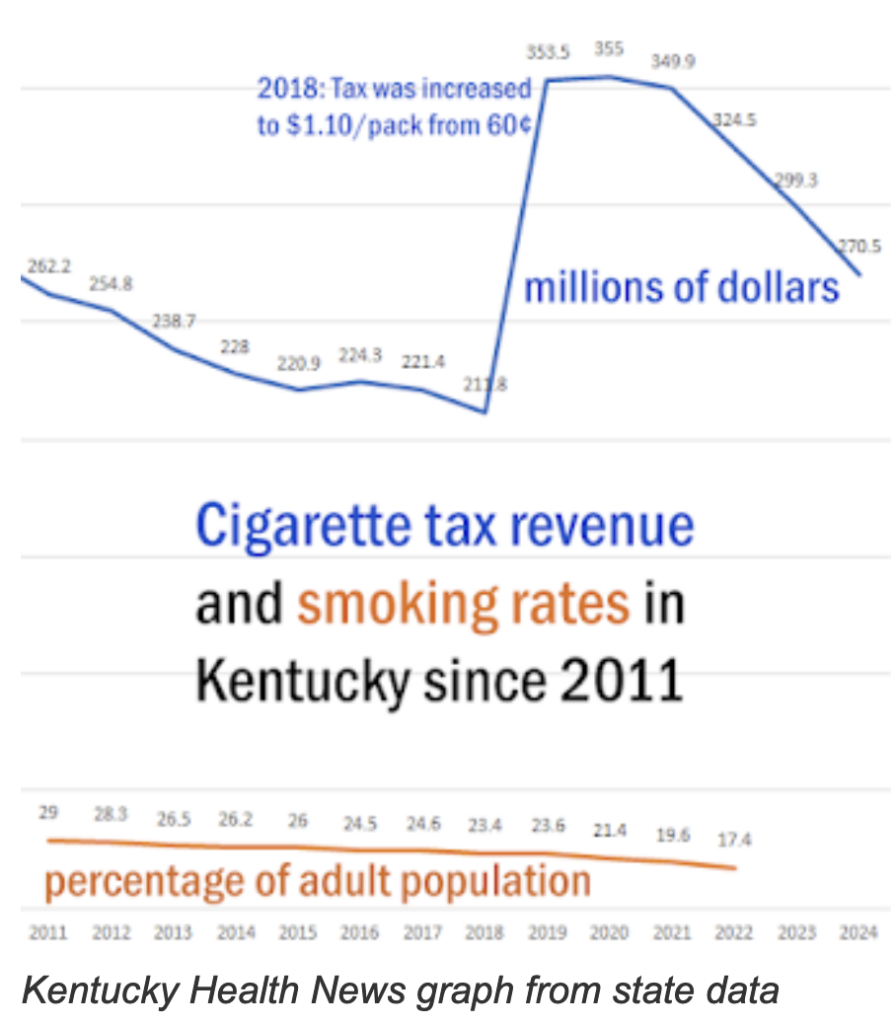

Cigarette tax collections in Ky. dropped after the last two tax increases; the state’s smoking rate has also been on the decline

Kentucky Health News

Increasing state cigarette taxes has proven to be an effective policy to decrease smoking rates, and it appears that is also true in Kentucky.

Shannon Baker, the American Lung Association‘s advocacy director for Kentucky and Tennessee, said that while she could not point to something definitive to explain why Kentucky’s smoking rate has been decreasing, as has also been the case in the nation, she could speak to the impact of raising cigarette taxes:

“When taxes increase, smoking rates decline. We should take advantage of that, for goodness sake, and increase the cigarette tax in Kentucky by at least $1 and then tax all other nicotine products at parity with the cigarette tax.”

After the initial boost in cigarette-tax revenue from the rate hikes in 2011 and 2018, revenue from the tax declined 24% from 2019 to 2024.

The legislature increased the tax to 30 cents from 3 cents in 2005, but smoking rates before 2011 should not be compared with those after that because of a change in survey methodology, says the Behavioral Risk Factior Surveillance System, a continuing federal-state poll of Americans’ habits.

Baker stressed that its important to take advantage of all policies that are known to decrease smoking. Beyond raising taxes, she said it’s important to fund the state tobacco-control program and enforce the law against underage sales, which she said would result in fewer youth becoming addicted to nicotine and growing up to be lifelong smokers, and all the health issues that come with that.

The new report on state General Fund receipts for the fiscal year that ended June 30 showed a 1.5% increase in receipts from other tobacco products, such as electronic cigarettes or vapes.

Asked about the impact of vaping on decreasing smoking rates, Baker focused her comments on young people, who are more likely to vape than smoke.

“We really have to get a handle on this youth vaping problem,” she said, noting that Kentucky is one of about 10 states that doesn’t require tobacco retailers to be licensed. “We don’t even know where all of these shops are in order to enforce the law against underage sales.”

Baker added, “We really need a better method of enforcing the law against underage sales. And what that looks like is licensure and routine regular enforcement opportunities that result in significant penalties all the way up to license suspension and revocation, for scofflaws that routinely violate the law. We’re not talking about any onerous policy on those who are compliant with the law. We’re simply talking about those who violate the law and violate it routinely.”

The 2023 Youth Risk Behavior Survey found that 5.3% of Kentucky high-school students said they currently smoked cigarettes and 19.7% said they used electronic vapor products. Among middle schoolers, the 2.2% said they smoked cigarettes and 12.8% used a vapor product. “Current use” is considered having used a product on at least one day during the 30 days prior to the survey.

Asked if she thought the new law that bans retailers from selling unauthorized vapor products would be effective in decreasing youth vaping, as it has been touted to do, Baker said, “House Bill 11 turned into . . . an industry market-share grab and nothing more; it is not a protection for kids. What we saw was a bill passing that, in effect would, if it’s upheld in court, remove certain products, primarily imported products, from the market shelves, which in and of itself is not a bad thing. But, it certainly doesn’t protect kids who will just switch to the other products that remain on the shelves.”

The law has been challenged in court. If it holds up, it will go into effect January 2025.

Baker also wanted to make sure people know that the funds for the state’s tobacco control program come from the Master Settlement Agreement with cigarette manufacturers, not from the cigarette tax.

“We need to increase funding for tobacco control because . . . Kentucky has the highest lung-cancer incidence and mortality rates in the entire nation and most of that is due to our high smoking rate,” Baler said. “So even though the smoking rate may be declining, it isn’t gone. It isn’t good, even.”