Here are tools and resources to help you understand how the health reform law impacts you, your family and your business

Kentucky Health News

The rollout of the insurance-buying section of the Patient Protection Affordable Care Act started Oct. 1, and regardless of where you stand on the law, it’s important to be informed about what will happen Jan. 1 when the law’s major provisions are set to go into effect. To help you understand how the health law impacts you, your family or your business, the Foundation for a Healthy Kentucky has compiled a list of links to information about the health law.

The law, informally known as Obamacare, is a set of health care reforms signed into law by President Obama on March 23, 2010. The law includes insurance mandates and requires everyone to have health insurance or pay a penalty starting Jan. 1. In addition to insurance mandates, both the establishment of online health-insurance exchanges and expansion of Medicaid are two essential elements of the law.

In June 2012, the Supreme Court upheld the health law in a 5-4 vote, saying its requirement that most Americans obtain insurance or pay a penalty was authorized by Congress’s power to levy taxes. The Internal Revenue Service will administer that provision of the law. The court ruling limited the law’s blanket expansion of Medicaid, which attempted to require all states to expand the program in order to receive federal funding, saying that each state could make its own decision.

The Kentucky Health Benefit Exchange, Kynect, was established in July 2012 and opened for enrollment Tuesday. Calling it “the single-most important decision in our lifetime for improving the health of Kentuckians,” Gov. Steve Beshear announced his decision to expand Medicaid in Kentucky in May. As a result of this decision, Medicaid has expanded to provide coverage to Kentuckians under 65 in households up to 138 percent of the federal poverty level—currently $15,856 for an individual or $32,499 for a family of four.

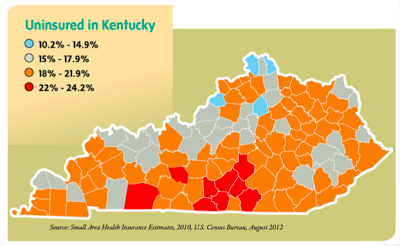

About 640,000 Kentuckians are uninsured, and 308,000 of them qualify for expanded Medicaid because their incomes are less than 138 percent of the federal poverty threshold. The remaining 332,000 Kentuckians must purchase private insurance through Kynect. Of those purchasing private plans, an estimated 83 percent will be eligible for at least some tax credit to do so, reports Kentucky Voices for Health, a group of health-reform advocates.

Currently, the federal government pays 71 percent of Medicaid costs, and the state covers 29 percent of the costs. Under Medicaid expansion, the federal government will cover 100 percent of the costs of the newly eligible people for the first three years. Starting in 2017, the federal government will cover 95 percent of the costs for this expanded population, and federal funding will phase down to 90 percent by 2020.

Currently, the federal government pays 71 percent of Medicaid costs, and the state covers 29 percent of the costs. Under Medicaid expansion, the federal government will cover 100 percent of the costs of the newly eligible people for the first three years. Starting in 2017, the federal government will cover 95 percent of the costs for this expanded population, and federal funding will phase down to 90 percent by 2020.

The Kentucky Voices for Health presentation, found here, gives more details about the overall purpose of the Affordable Care Act and its implementation in Kentucky. Get Covered Kentucky, a coalition spearheaded by Kentucky Voices for Health, compiled additional information about Medicaid expansion. Click here for these tools and resources.

Beshear says Medicaid expansion is the right choice for Kentucky, providing numerous reasons and county-level data to explain why not expanding the program would hurt both Kentucky’s health, which already ranks poorly in many health categories, and taxpayers’ bottom line. Click here to see the impact of health reform on your local community.

You may be eligible for coverage through Medicaid or tax subsidies to help you purchase private insurance. Go the the Kynect website to determine your eligibility for Medicaid coverage or private insurance subsidies and to enroll Medicaid, the Kentucky Children’s Health Insurance Program or private plans. “It’s easy to apply, with just one application to fill out. When you apply online, you get enrolled quickly. We also have insurance agents and Kynectors who will help you apply using computers,” says the website. If you want to apply by mail or fax, click here for paper applications.

The law does not require small employers (businesses with 50 or fewer employees) to provide insurance coverage. If you own a small business with 25 or fewer employees, there may be significant tax credits available through Kynect to help cover the cost of insurance. Since the mandate to cover employees has been delayed for a year, businesses with more than 50 employees will not face penalties in 2014 for not providing health insurance, but they may face penalties starting in 2015.

The foundation resource page includes additional resources to help you understand health reform efforts at the federal level, including those from the Kaiser Family Foundation, which includes a subsidy calculator, the Robert Wood Johnson Foundation and a fact page from the U.S. Department of Health and Human Services. In addition, a foundation report outlines how the health law creates opportunities to address public health issues, decrease health disparities and reform care delivery.