Insurance firm’s study found Kentucky’s costs for long-term, in-home care dropped this year, even as nation saw an increase

Kentucky Health News

The cost of in-home, long-term care in Kentucky is less than it was a year ago, an insurance company study says. That should come as good news to Kentucky seniors, who are some of the unhealthiest in the nation.

“Although home-care costs are much less expensive than those in facility-based settings, the costs can add up to as much as $42,900 per year in Kentucky, which is why it’s imperative for consumers to begin planning now for how they will pay for that care should they need it,” Tom McInerney, president and CEO of Genworth, the company that conducted the study, said in the a news release.

McInerney said 70 percent of Americans over age 65 will need some form of long-term care and support during their lives.

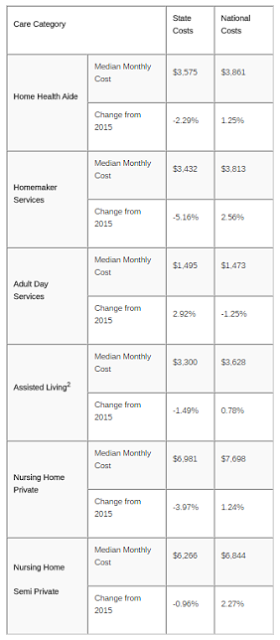

Genworth’s 13th annual Cost of Care Study found a cost decrease in most of the in-home care categories measured in Kentucky, with the only increase found in adult day services, which were up 2.9 percent. Nationally, cost for long-term in-home care increased.

Homemaker services, which cost an average of $3,432 a month in Kentucky, showed the largest decrease: 5 percent. There was a 4 percent cost drop in private nursing home care, which runs about $7,000 per month.

The state also showed decreases in cost for home health aides (down 2.3 percent), assisted living (1.5 percent) and semi-private nursing homes (1 percent).

In addition, the report broke down cost trends in the state’s major metropolitan areas.

For example, the cost of private nursing-home care is about 10 percent less in Bowling Green than the national average, at $6,905 per month; and homemaker services in Lexington are about 8 percent less than the national average, at $3,527 per month.

The latest study gathered data from more than 15,000 long-term care providers nationwide and includes 440 regions, including all metropolitan statistical areas. It was conducted in January and February.

As cost for long-term care services rise, it is important for consumers to plan ahead, Genworth said.

Options for paying for long-term care include self-funding, government assistance and long-term-care insurance.

Genworth says you need to start saving early if you plan to self-fund. “Saving for long term care on your own can be difficult and take years to accumulate funds,” says the release.

Government assistance options include Medicare and Medicaid. “Medicare pays for long-term care if you require skilled services or rehabilitative care such as in a nursing home (max. 100 days) and at home if you are also receiving skilled home health or other skilled in-home services (provided for a short period of time),” says the release. Visit longtermcare.gov for more information.

“Medicaid covers a large share of long-term care services, but to qualify your income must be below a certain level and you must meet minimum state eligibility requirements and be in a Medicaid-approved facility,” says the release. Visit Medicaid.gov for more information.

The other option is long-term care insurance, which provides a “guaranteed lifetime source of income” to pay for long-term care and other expenses, says the release.

The National Association of Area Agencies on Aging is another resource to learn about long-term care and other aging issues.