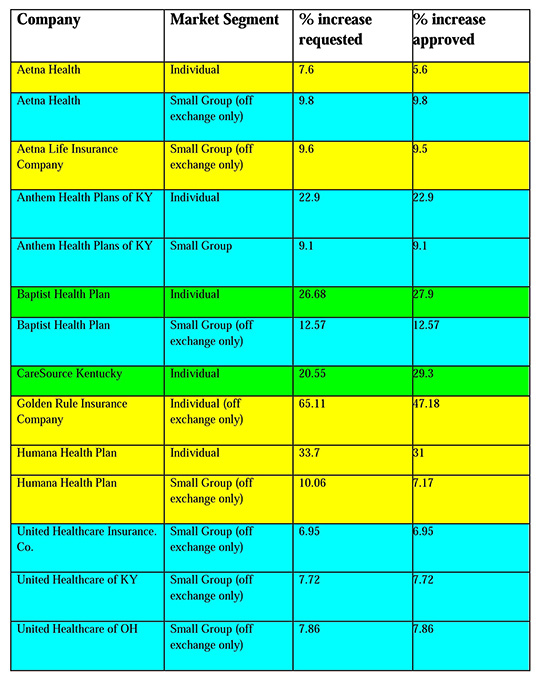

Health insurers get almost all of the rate hikes they requested for plans on exchange; some get more than they asked for

The major exceptions were a 5.6 percent hike for individual policies sold by Aetna Inc., which asked for an overall 7.6 percent increase; and CareSource Kentucky Co., which asked for a 20.55 percent increase on its individual policies, but was assigned a higher rate of 29.3 percent.

The Insurance Department concluded that the requested CareSource rate wouldn’t produce enough money to pay the claims likely to be filed.

“Based on actuarial review, it was determined the rate initially requested by CareSource would be insufficient to meet the company’s obligations which would ultimately lead to a harmful scenario for consumers,” Doug Hogan, spokesman for the Public Protection Cabinet, said in an e-mail to Kentucky Health News. CareSource will offer individual policies in 61 counties.

Baptist Health Plan also got a higher individual-policy increase, 27.9 percent, than what it requested, 26.7 percent. It will offer individual plans in 20 counties. Humana Inc. got the largest increase for individual plans on the exchange, 31 percent, after requesting 33.7 percent. It will offer individual plans in nine counties. Aetna will offer individual plans in 10 counties.

UnitedHealth Group Inc. announced in April that it would no longer sell individual insurance plans in Kentucky, leaving many counties with only one insurer on the exchange. As a result, Anthem Health Plans of Kentucky Inc. will be the only company offering individual policies in every county through the exchange in 2017. It will be the only choice on the exchange in 54 counties. Anthem was given a 22.9 percent increase on its individual plans, what it requested.

Insurance companies had asked for an average rate increase of 29.4 percent for individual health policies, but the state only approved an average rate increase of 27.3 percent, though this does not reflect the insurers’ market share because the average is not weighted to factor in each insurer’s percentage of the market.

“The Department of Insurance carefully reviewed each request to ensure its compliance with Kentucky law, pushed back where possible and sought to ensure each request was properly supported,” Insurance Commissioner H. Brian Maynard said in a news release from the cabinet.

He blamed the increases on federal health reform and the failure of the still-in-liquidation Kentucky Health Cooperative, created under the reform law.

“Obamacare has infused our state’s health-insurance market with unnecessary volatility and uncertainty,” Maynard said. “Far from helping to lower health-care costs, Obamacare is driving up costs and burdening our citizens. That’s reflected in the filings the department reviewed.”

As expected, insurers asked for higher rates because they expected to absorb the 50,000 co-op customers, most of whom were high-risk.

The cooperative attracted many of the state’s unhealthiest people, causing it to pay out much more than expected in claims. It announced in October 2015 that it was closing, but said it could have survived if Republicans in Congress had not greatly reduced funding for the “risk corridor” program, which subsidizes insurers who take on high-risk customers. The co-op, which had a deficit of $50 million in 2014, was expecting a risk-corridor payment of $77 million but got only $9.7 million.

Only seven of the 23 state-based, non-profit cooperatives, created under health reform to compete with for-profit insurance companies and hold down premiums, are still operating, according to Healthinsurance.org.

Click here to see the 2017 health rate filings. Click here to see the plans offered in each county.