Sales pitches for Medicare Advantage don’t tell the whole story

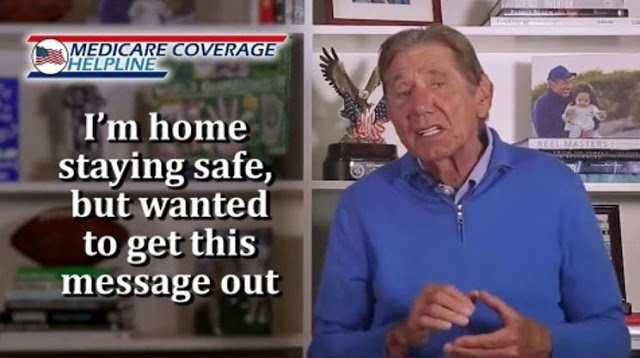

Joe Namath is perhaps the most familiar spokesperson for Medicare Advantage plans.

—–

By Trudy Lieberman

Community Health News Service

It seems nothing ever changes when it comes to hawking insurance to fill gaps in Medicare coverage. The fervent sales pitches, the misinformation, and the incomplete and deceptive information continue to proliferate.

For the last several weeks I’ve heard ad after ad urging older viewers to call 800 numbers to learn about the latest and greatest Medicare Advantage (MA) plans. Retired football star Joe Namath says you need to “get everything you’re entitled to.” Namath rattles off a bunch of extra benefits MA plans offer – dental, vision, hearing, prescription drug coverage – “all at no extra cost.” He urges viewers to “call the number on your screen now. It’s free.”

These are new benefits the government has let private insurers sell in hope of getting more seniors to leave traditional Medicare for a privatized system. By transferring more costs to seniors, the government saves taxpayers money.

Another commercial promises “free eyeglasses and free rides,” presumably to doctors’ offices. Yet another tells viewers they “may qualify” to get $144 added back to their Social Security benefits. The Medicare Part B premium for 2021 is $148.50, which is, presumably, what the commercial promises to save those who choose the privatized system.

I suspected those ads were misleading and deceptive come-ons, designed to persuade listeners to call. So I made some calls. The 800 numbers lead to an insurance brokerage firm or agency that apparently has a network of licensed agents located around the country. Callers are asked to give their ZIP code and then are transferred to an agent who can give the “free benefits” review.

I have heard close to 100 Medicare sales pitches over the years and know that those free consultations are meant to result in a sale, whether or not the senior needs the insurance or is really getting a better plan.

Seldom is there talk about making sure people are covered for the huge amounts doctors and hospitals sometimes charge and Medicare doesn’t cover. What are the trade-offs, for example, between buying an MA plan, which pays those charges after you satisfy a large out-of-pocket maximum ($6,700 per person next year) or buying a traditional Medigap insurance supplement Plan G, which covers those charges right away? A couple with Medicare Advantage could pay as much as $13,400 a year before their plan would pay for anything!

With so many choices, what’s a consumer to do? I rang up Bonnie Burns, one of the best Medicare consumer advocates in the country, for advice.

“It’s just too complicated,” she said. “No wonder people throw up their hands. That’s why people sign up for an Advantage plan with little or no premium and find out what the costs really are as they use benefits through the year.” She added, “It would be so much easier if Medicare Advantage plans and drug plans were standardized so people could figure this out.”

Congress could do that, but hasn’t, resulting in today’s chaotic marketplace. Congress wanted to allow every insurer in the universe to throw something out there so the companies could make money and could entice more people to leave traditional Medicare. The goal was to reduce taxpayer costs, all the while side-stepping any action to control run-away medical costs.

Congress did standardize Medigap policies in the early 1990s because that market was as chaotic and misleading then as the MA market is today. I like to think of that action as the high-water mark of consumer protection, and I have no illusions that anything like it will happen again anytime soon.

One final bit of crucial advice is missing in today’s ads. Even after you enroll in an MA plan, perhaps enticed by a few dollars in savings for a pair of glasses, you can return to traditional Medicare in the future. But in all but four states (New York, Connecticut, Massachusetts, and Maine) state laws prohibit you from buying a Medigap plan without an insurer scrutinizing your health status.

If you have developed a pre-existing condition, you may be ineligible for a Medigap policy. I’ve met many people over the years who bought an Advantage plan, got sick, and needed to go to out of network for treatment. They learned the hard way they were shut out of the Medigap market for good.

What choices have you made for covering Medicare gaps? Write Trudy at trudy.lieberman@gmail.com.